What is Freight Insurance, and why do you Need it?

Shipping cargo worldwide is a complex and dynamic business, challenged by physical, climate, geographic, human, and political risks. When goods are in transit, they are subject to many hazards. Carrying freight insurance to protect against these perils is a crucial business practice.

You may be confused about putting together the best program for your needs to insure cargo in transit. Because your freight insurance program depends on many different factors, like what you are shipping and where it is going, having an expert help you is essential.

Read on to learn more about shipping insurance and why you need it, then contact us for more help.

What is Shipping Insurance?

Freight insurance is designed to cover the damage or loss of goods in transit. There are many different options on how to secure shipping insurance to cover your freight depending on how it is being transported or the type of freight it is. Regardless of the type of shipping insurance purchased, it is essential to understand your coverage as freight moves from one location to another. Customized freight insurance is vital for your business, and Cabrella can help guide you through the shipping insurance process.

LTL Carrier Insurance

LTL means Less Than (Truck) Load insurance. LTL carrier insurance is when many different shipments are transported together on the same truck to different destinations. Amazon vans are a common example of LTL shipping – the van or Amazon truck has hundreds of packages delivered to various households from different vendors. Large tractor-trailers can also be used for LTL deliveries, although usually to warehouses and commercial locations rather than individual homes.

-png.png)

One risk introduced by LTL shipping is that the truck stops many times to pick up or offload deliveries, leading to the possibility of damage or loss. With large tractor-trailer LTL shipments, the truck may deliver to a warehouse where goods are moved to other trucks for further delivery, leading to possible errors.

LTL shippers often use smaller trucks or conversion vans to make their deliveries. These smaller vehicles do not require drivers to be commercially licensed like they would need to drive a large tractor-trailer. This can introduce some risk factors by employing a potentially inexperienced or untrained commercial driver to operate the truck.

Further, because LTL generally goes via ground, the transit time can be long and there can be many rest stops for drivers along the way - leading to increased chance of theft and loss.

Truckload Insurance

Truckload insurance is designed to insure a full truckload of product from the same source, generally going directly from the supplier to the customer. Unlike LTL shipping, there is no need for the truck to stop to offload or load more products from different places because it is already full and is being used by one consignor, reducing the risk of loss or damage to goods from unloading and reloading. However, the delivery is still at risk from the usual weather, traffic, and other shipping-related perils and delays.

Air Freight vs. Ocean Freight

You may be wondering if you should select air or ocean freight for your cargo shipping needs. The answer may be more straightforward than you think – some types of freight have to be shipped a certain way due to legal issues, so regulations may make your decision for you. For example, flammable, toxic, or corrosive items likely do not meet TSA requirements to fly, so you would need to ship these items by ocean freight.

The cost may be another consideration. Ocean freight costs tend to be lower than shipping the same cargo by air freight would be. However, you are paying for a much faster delivery time with air freight as compared to ocean freight. The same ocean journey may take weeks or months, whereas, by air, it would take hours or days to complete. The longer time spent in transit leads to more risk.

Ocean freight has less environmental impact than the carbon footprint of flying. If this is important to you or your customer, choosing ocean freight may be a more ecologically friendly option. However, air freight tends to be a safer option. Ocean freight may travel through rough waters or parts of the world where their cargo is considered highly valuable – maritime piracy remains an issue even in 2021. Highly valuable or fragile cargo may be better off shipped by air freight.

These are all important considerations to weigh when considering air freight vs. ocean freight based on your cargo type, your needs, and those of your customer, your budget, and your timeline.

Why do you Need Freight Insurance?

There are many reasons to consider purchasing freight insurance. The most obvious reason is that accidents and losses happen, and shipping insurance is smart to protect your investment. This is the same reason why we carry insurance on our cars, homes, and businesses. If your shipment is damaged in transit, your LTL or truckload carrier will likely have some coverage, but it will probably not cover you in full.

In the United States, each carrier will provide limited coverage which depends on the commodity and weight. As an example, commodity type A may have a maximum liability of $1.00 per lb included. If the item weighs 1,000 lbs, the carrier may only cover you to $1,000 in value - based on the example above. If your item is actually worth $50,000, one can see that they are severely underinsured. By contrast, in Canada, all carriers provide a standard $2.00 CAD of coverage per unit of weight, regardless of the commodity.

Many times, shippers use freight forwarders that offer additional insurance to cover this discrepancy; however, purchasing additional insurance from a freight forwarder can be cost prohibitive as the rates are often marked up extensively. Having your own coverage coordinated to protect your investment is a sound business strategy as this allows for control of your insurance, transparency on coverage and cost savings.

Filing a Claim

Even with the most well-controlled shipping programs, accidents and unexpected delays occur, and you may need to file freight claims. It is essential to understand the reasons to file claims and how these claims will be handled in those cases.

Reasons for Shipping Claims

Freight claims may be filed for several reasons. If you receive damaged cargo, you might file a claim for:

- Damage – Visible damage to the shipment which is noted upon delivery

- Loss – Freight is not delivered to the endpoint – lost in shipment

- Shortage – The shipment is partially received but not in full

- Concealed Loss or Shortage – Loss or damage that is not immediately noticed upon delivery – it is concealed or hidden inside the delivery and noticed later when packaging is opened

Benefits of having your own coverage

As you can imagine, filing claims and dealing with loss representatives of carriers can be a nightmare. This is no surprise as carriers are experts in logistics and not insurance. By contrast, allowing the carrier to handle freight while having a dedicated insurance provider deal with claims is much more efficient. By making this decision, you have a claim representative handle and adjust your claim for you without delay or dependence on amounts included with carrier liability. Generally speaking, the insurance company would pay the shipper in full and then work with the carrier to subrogate based on any amounts the carrier is legally liable for, by contract - allowing the shipper to spend more time on their business and less time dealing with a lengthy and convoluted claims process.

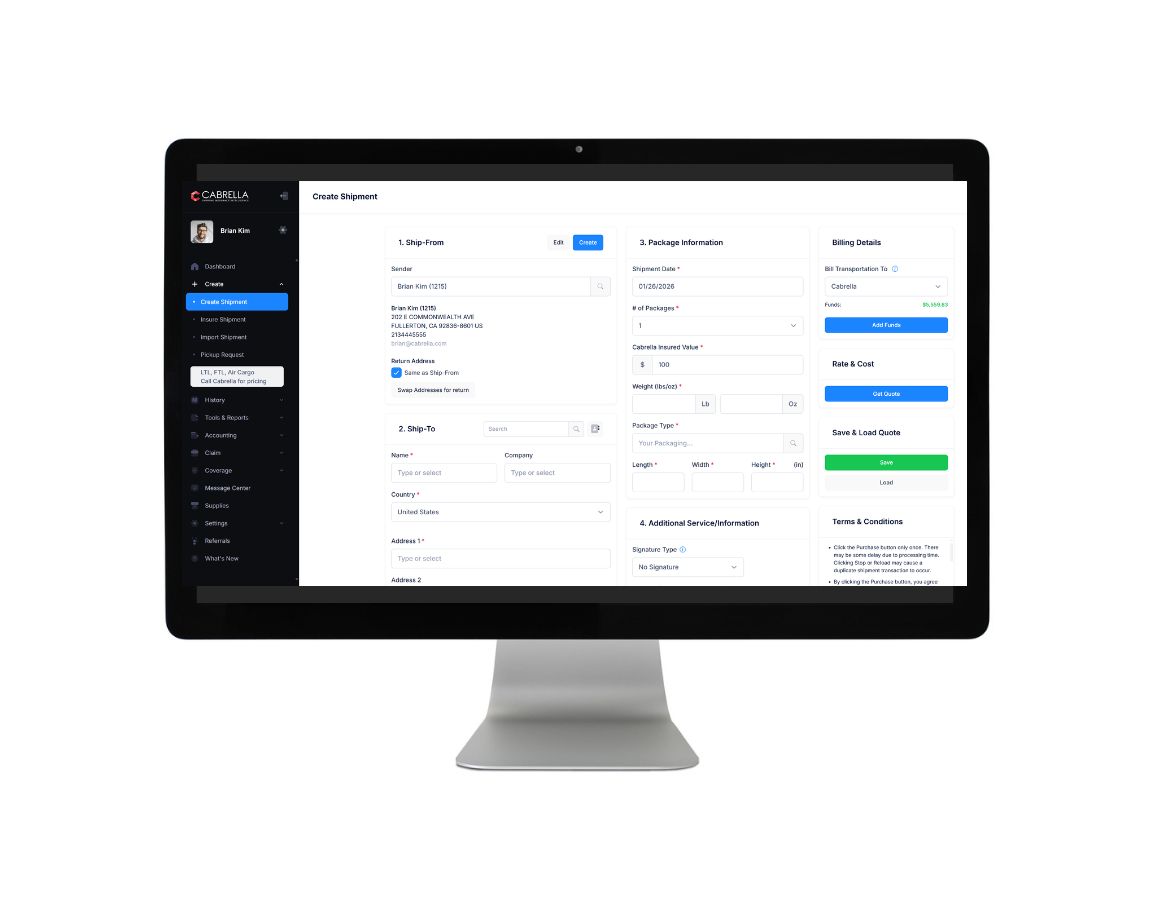

Shipping Software

Cabrella is a shipping insurance software system that allows customized freight insurance solutions to meet your shipping insurance needs. Cabrella’s system is integrated with major shippers like FedEx and UPS as well as local and regional carriers and will enable customers to secure insurance for shipments with ease through API and other integration tools.

Contact us to learn more.

Final Thoughts

It is vitally important but challenging to coordinate a program for complex freight insurance needs, and you need an agency that is well-versed in the nuances of shipping insurance. Whether you are shopping for air freight, ocean freight, LTL, or truckload insurance, Cabrella can help guide you through these complex coverages.

Cabrella can help you save money on shipping costs by offering low-cost, high-quality shipping insurance. To learn more about the need for freight insurance, contact the experts at Cabrella at 844.422.2735. Our professionals will be happy to answer any questions you have.

Keep Checking Out Our Other Posts

Subscribe for Email Updates